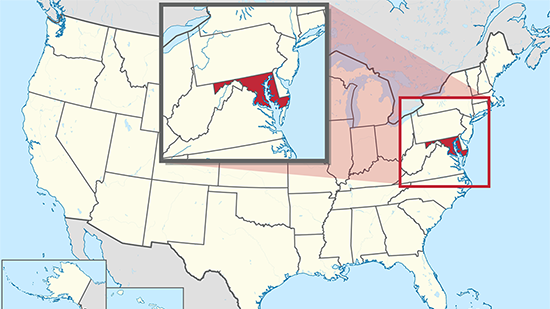

Maryland: Payday Lenders Skirt Regulation by Adding a “Broker Fee”

Maryland Had To Amend Its Payday Lending Law That Capped Interest Rates After Payday Lenders Started Charging A Separate “Broker Fee” That Would Bump Up The Real Interest Rate To As Much As 600%.

“Maryland, which has had a limit on consumer loan interest rates for several decades, had to amend state law several years ago when payday loan companies found a way around the interest cap by charging a separate broker fee. Sure, they billed only 33 percent interest (the maximum allowed under state law), but add in the fee and it could be as much as 600 percent.” [Editorial, Baltimore Sun, 8/25/13]

Payday Lenders Circumvented Maryland’s Payday Loan Rate Cap By Charging A Broker Fee That Along With Interest Would Represent An APR Of 640% Or Higher. “Since the mid-1970s, Maryland has had an interest rate cap of 33 percent on consumer loans of $6,000 or less. For the most part, that’s kept payday lenders out of the state. And it’s earned Maryland a reputation of being tough on lenders that try to exploit vulnerable residents. So regulators were concerned when they started getting complaints about a year and a half ago that payday lenders, mostly over the Internet, had developed a new business model that attempted to circumvent Maryland’s rate cap. A payday lender would charge the most it could under Maryland law for the short-term loan. But to get the loan, consumers had to go through a broker that charged at least $20 per $100 borrowed. That fee wasn’t included in the interest rate on the loan, according to the Center for Responsible Lending. But if you factored in all the fees, Marylanders were paying a rate of 640 percent or higher, state regulators say.” [Baltimore Sun, 4/13/10]