The Watergator: Ted Saunders of Community Choice Financial

Ted “Watergate” Saunders has been the Chief Executive Officer of payday lender Community Choice Financial, Inc. since June 2008.

Saunders has long fought to block regulation of the payday lending industry. Recently, he equated a supposed federal crackdown on payday lenders with Watergate and called it “government overreach.” He also equated closing payday lending stores with closing hospitals. Seriously.

In 2008, he complained that a measure democratically approved by Ohio voters that capped interest rates on payday loans at 28 percent APR would close his business and cause layoffs. After the measure was passed, however, Saunders took advantage of loopholes in the law to earn the same triple-digit interest rates on payday loans that he had before, yet still complained that he wasn’t making enough profit.

He called efforts to close those loopholes a “witch hunt.” Saunders also offered a prepaid debit card to customers to get around the law that included a 400 percent APR, which he said he was “proud to provide” and that criticism of those cards was a “new low.”

Saunders has claimed that any criticism of payday loans was insulting to his costumers and that they were “appreciative” of the loans. At the same time, he blamed customers who got into a cycle of debt for abusing the loans he offered. He even attempted to offer financial advice to college graduates by telling them to avoid “accumulating too much debt.”

Despite Saunders’ claims that new regulations would put him out of business and force layoffs, his company has earned millions in profits since regulations were passed in Ohio in 2008.

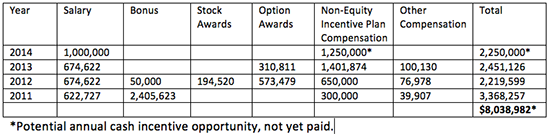

Since 2011, Saunders has personally earned over $8 million not including a $6.4 million retention bonus that he will be paid out over the next three years starting this year. Not only does he earn millions in salaries and bonuses, the company also picks up the tab for lavish perks like $11,400 for automobile expenses, personal use of the corporate jet, and a personal trainer. Yep, trapping consumers in a cycle of debt has paid off handsomely for Ted “Watergate” Saunders.

It’s paid off for others too. During the past several election cycles, Saunders has contributed at least $47,000 to the campaigns of powerful politicians and payday lending special interest PACs, which have also donated large sums of money to the campaigns of elected officials.

Saunders owns this 5,406 square foot $2.1 million home in Columbus, Ohio with a 900 square foot garage.

Prior to his role as CEO at Community Choice Financial, Saunders served as its Chief Financial Officer from March 2006 to June 2008. Previously, Saunders was a Vice President for Stephens, Inc., an investment bank from 2004 to 2006 and, prior to that, was an associate at Houlihan Lokey, an investment bank, SunTrust Equitable Securities, an investment bank, and Arthur Andersen, an accounting firm.

The Details:

Saunders Equated Federal Regulation and Crackdown of Payday Lenders to Watergate

- Saunders Called Government Crackdown On Illegal Corporate Operations “Government Overreach.” “The overreach of federal agencies under the Obama administration continues ad nauseam in the latest iteration, aptly dubbed ‘Operation Choke Point.’ This government crackdown has extended its dragnet far beyond its initial stated task last year of prosecuting those breaking the law. It is now targeting approximately 30 industries, including tobacco (not marijuana, mind you), guns, telemarketing, dating services and my industry of consumer lending — any industry with which the current administration has a political or philosophical disagreement. Rather than prosecuting those operating illegally, the government is pressuring banks to stop doing business with short-term lenders, regardless of whether they’ve done anything wrong. I am extremely concerned that my customers will be hurt by the very regulators sworn to protect them. My customers, who earn an average of $30,000 to $50,000 per year, rely on short-term loans at times to get them through cash-flow emergencies. These individuals certainly don’t need us all the time. But, when they do, they know they can borrow a small sum of money to get them through their cash crunch and pay it back when they get paid.” [Saunders, Columbus Dispatch, 7/26/14]

- Saunders Called Crack Down “A Bigger Abuse Of Power Than Watergate.” “Community Choice Financial Inc. has been ensnared in the federal government’s efforts to stamp out businesses deemed objectionable, CEO Ted Saunders says. The Dublin-based parent of CheckSmart and other payday lending and check-cashing businesses has seen five business relationships with banks and other service providers ‘inexplicably’ cut off over the last year, Saunders said, and he suspects the Justice Department’s Operation Choke Point. ‘We had a 20-year relationship terminated directly as a result of regulatory pressure,’ Saunders told me. ‘It’s a bigger abuse of power than Watergate.’ The Justice Department’s efforts to weed out bad actors such as shady offshore Internet lenders – a push supported by Saunders and others legally operating in the industry – has evolved into a program that critics say is sealing off the U.S. financial system to legitimate businesses such as firearms makers, adult entertainment companies, and payday lenders. Saunders would not name the banks and payment processors that he believes were effectively forced to stop doing business with him, and he predicted those companies would not publicly acknowledge it either.” [Columbus Business First, 6/17/14]

Complained That Measure Passed by Ohio Voters Capping the APR on Payday Loans at 28 Percent Would Close His Business and Layoff Workers

- Saunders Claimed Payday Loan Interest Rate Cap Was “A Tremendous Blow To The Company” And Said He Had TO Lay Off Employees. “More than a third of Ohio’s payday lending storefronts have been shuttered since new restrictions on short-term lending took effect six months ago, state officials said. Payday lenders operated roughly 1,600 retail locations across Ohio before voters approved new restrictions. Now, payday lenders run just 960 storefronts. While industry operators bemoan their struggle to keep running their businesses, critics charge they are using loopholes in the state’s regulations to continue lending at high interest rates. The debate will likely pick up steam as Ohio legislators mull a bill to be introduced this month by state Rep. Matt Lundy, D-Elyria, to further limit short-term loans. Possibly hardest hit among the largest chains in Ohio is Columbus-based CheckSmart. A chain of 215 stores still has 95 stores in Ohio. ‘The change has been a tremendous blow to the company – I’ve closed 10 or 15 stores and I’ve got more on a watch list,’ said chief executive Ted Saunders. ‘We were on a growth spurt until this happened.’ So far, Saunders said, he’s cut about 100 jobs statewide and now employs about 750 in Ohio and about 1,400 total. And more cuts are on the way.” [Cincinnati Enquirer, 2/18/09]

- Saunders Claimed 28 Percent Interest Rate Cap Would “Effectively Eliminate” His Business Because IT Would Require “Companies To Make Loans For $1.08 Per $100 Borrowed.” “The bill that Lundy described this week includes a 28 percent annual interest-rate cap as its core feature. This would effectively eliminate short-term loans originated by a variety of financial institutions in our state, requiring companies to make loans for $1.08 per $100 borrowed, or about 8 cents per day for a two-week period — far less than Dispatch readers pay each day for a copy of the paper.” [Ted Saunders, Columbus Dispatch, 6/20/09]

- Saunders Opposed Interest Rate Cap: “Taking It To 28 Percent And Forcing That ($15) Transaction To Happen For A Buck … Doesn’t Work.” “Is 391 percent interest too high? The question is the basis for a campaign in favor of passing Issue 5, which would reduce the amount payday lending establishments are allowed to charge from 391 to 28 percent annual interest. Opponents of the issue say the number — used to describe the percent interest rate on loans provided by payday lending companies across the state — is a misrepresentation. ‘It’s a big scary number, and it doesn’t represent the substance of the transaction,’ said Ted Saunders, chief executive officer of Checksmart, who spoke opposite Bill Faith, treasurer of the Vote Yes on 5 committee, in a forum hosted Oct. 9 by the Newspaper Network of Central Ohio. During spring, the state passed House Bill 545, which lowered the interest payday lending establishments are allowed to charge to 28 percent and set a loan maximum of $500. If Issue 5 were to fail, the 28 percent cap no longer would be applicable. Faith said a ‘yes’ vote on the issue would keep the 28 percent cap — a rate opponents said would put them out of business. ‘Taking it to 28 percent and forcing that ($15) transaction to happen for a buck … doesn’t work,’ Saunders said.” [Newark Advocate, 10/16/08]

- Saunders Campaigned Against Measure To Cap Interest Rates On Payday Loans, Said Payday Businesses Stop Operating In States With Capes. “Columbus-based CheckSmart Chief Executive Ted Saunders had said during the Issue 5 campaign that payday lenders typically stop doing business in states where the interest rates are restricted.” [Dayton Daily News, 11/7/08]

- November 2008: After It Was Enacted By Ohio Voters, Saunders Claimed 28 Percent Interest Cap Would Put Him Out Of Business: “We’re Doing Everything We Can To Survive.” “One payday lender said current Ohio law, upheld by voters in the Nov. 4 general election, will not allow the loan stores to remain in business. Ted Saunders, chief executive officer of Checksmart, said the company will pursue other options to keep operating its 98 Ohio stores, but its 700 Ohio jobs now are in jeopardy. Checksmart has 18 stores in central Ohio, including one at 801 Hebron Road, Heath. ‘The (voters’) decision deeply hurt our business, and we’re doing everything we can to survive,’ Saunders said. ‘We’re pursuing other lending alternatives available to us, according to different state statutes.’ The company has just one store in Licking County, but also two in Reynoldsburg, one in Zanesville and several in Columbus. Voters approved Issue 5, which kept in place House Bill 545, which lowered the interest rate payday lending establishments could charge from a 391 percent annual percentage rate to a 28 percent maximum rate. Consumer advocates had argued payday lenders were taking advantage of vulnerable people, who become trapped in a cycle of debt that causes them to bounce around from one payday lender to another. ‘Nobody is going to do business under what HB 545 created,’ Saunders said. ‘I have 700 employees in the state, and I’d like to make a go of it. We have a window of opportunity to keep the doors open.’” [Newark Advocate, 11/17/08]

…and Then Took Advantage of Loophole in the Law to Keep Charging the Same Rates, but Still Complained He Wasn’t Making Enough Profit to Avoid Layoffs

- Saunders Defended Taking Advantage Of Loophole To Keep Operating Payday Lenders In Ohio And Complained He Wasn’t Making Enough Profit: “That Technically He’s Making Less On Loans Because Customers May Choose To Cash Their Money Orders Elsewhere.” “Ohio supposedly rid itself of payday loans. But visit just about any storefront that used to offer the short-term, high-cost loans, and you will find a mighty similar product. It’s just not called a payday loan anymore. ‘With the state law changing, it now costs more to do business with these people than before,’ one Middletown man complained to the Ohio attorney general. Thank a loophole in state law. Last year, the state legislature voted to rescind the 12-year-old law that exempted payday lenders from the state’s usury laws – a vote Ohioans overwhelmingly supported in a bruising November referendum. HB 545 was supposed to help consumers by creating a Short-Term Loan Act that gave borrowers at least a month to pay off loans. More importantly, the new law was supposed to drive down the costs. Where payday lenders had been allowed to charge a jaw-dropping 391 percent annual interest rate on the loans, the Short-Term Loan Act specifically capped the APR at 28 percent, the state’s usury threshold. But a quick check of former payday loan stores shows that many continue to offer two-week loans with triple-digit APRs, just like in the old days. Lenders switched their licenses so they could offer payday clones under two parallel lending statutes, the Small Loan Act or the Mortgage Lending Act. The switch allows them to do business pretty much as usual. By nudging the loan amount to just above $500, lenders can double the loan origination fees from $15 to $30. The Small Loan and Mortgage Lending acts allow the fees on top of the 28 percent interest, something the new law doesn’t permit. Last year, payday stores gave loans to customers as cash, but this year lenders present loans in the form of checks or money orders, which they then charge additional fees to cash. So when payday lending was legal last year, CheckSmart customers paid $575 to walk out the door with $500 in cash. Under the new licensing scheme, CheckSmart customers pay the same $575 to walk out the door with $500 in cash. CheckSmart Chief Executive Ted Saunders says that technically he’s making less on loans because customers may choose to cash their money orders elsewhere. He said he gives loan customers a discount on check cashing and ensures that customers don’t wind up spending more now for loans than they did last year.” [Cleveland Plain Dealer, 2/16/09]

- Saunders Defended Company From Survey That Found His Company Charged Triple-Digit Interest Rates Despite 2008 Law Cracking Down On Payday Lenders: “Our Customers Get A Bad Rap.” “A survey of 69 payday-lending stores in 2009 by Policy Matters Ohio found that every lender continued to charge triple-digit interest rates even after reforms were put in place in Ohio designed to lower the cost of a loan for borrowers. But Ted Saunders, CEO of Community Choice Financial, which operates payday lenders in 14 states that include the CheckSmart brand in Ohio, disagreed with the assessment. He said those reforms cut the fee on a $500 loan, for example, from $75 to $30. ‘Our consumers get a bad rap,’ he said. Those who get payday loans, online or otherwise, weigh alternatives, including short-term loans from banks, before deciding that a payday loan is cheaper than late fees or bounced check fees that they might otherwise incur, he said. Community Choice does not offer payday loans online. He said the company’s business tends to grow in the last half of the year through the holidays. Some consumers anticipate paying the loans back early next year with income-tax refund checks. They are using loans to help preserve credit ratings and to help make ends meet, he said. And they are more careful now than before the recession, when they might have borrowed more for a holiday splurge. ‘I believe consumer attitudes are much more conservative than before the economy slowed down,’ Saunders said.” [Columbus Dispatch, 12/11/11]

- Saunders Claimed He Was “Encouraged” To Take Advantage Of Loophole Allowing His Company To Avoid Adhering To Ohio Law That Capped Interest Rates On Short Term Loans At 28 Percent. “Ohio’s payday lending industry, which just got a welcome green light Wednesday from the Ohio Supreme Court, likely will get extra time before federal regulators crack down. Consumer Financial Protection Bureau Director Richard Cordray on Tuesday addressed senators’ concerns about several delayed rules, including those on short-term, small-dollar loans. Cordray said the consumer financial watchdog would take its time so it doesn’t leave any loopholes, citing work-arounds to a federal rule intended to cap interest rates on loans to military personnel, according to American Banker magazine…In Ohio, meanwhile, industry opponents say payday lenders are using a loophole by registering under the Mortgage Loan Act, rather than complying with the Short-Term Lender Act introduced by state lawmakers in 2008, which caps payday loans at 28 percent. In an opinion released Wednesday, the Ohio Supreme Court ruled that the regulation geared toward payday loans does not apply to similar types of loans made under the MLA. Ted Saunders, CEO of payday lender Community Choice Financial Inc. in Dublin, said that doesn’t mean it’s a loophole. ‘I was at the statehouse (in 2008) telling people no one would operate under that. It’s a way for our detractors to put us out of business,’ Saunders told me Wednesday after the Ohio Supreme Court ruling. ‘It’s awfully hard for me to accept a detractor saying this was loophole, when clearly it was legislative intent. The facts of the matter are we were encouraged to do business under these laws.’” [Columbus Business First, 6/11/14]

- Saunders: “There’s Nothing Illegal Or Improper About The Way We Do Business In The State Of Ohio.” “The state’s payday lenders earned a victory Wednesday with the Ohio Supreme Court ruling the companies can continue making short-term, single-installment loans. The opinion reverses a judgment from the Ninth District Court of Appeals that said Ohio Neighborhood Finance Inc.’s Cashland stores were skirting legislation – Short-Term Lender Act – introduced by the General Assembly six years ago that capped loan amounts and interest rates. The suit will go to trial court for further proceedings… Ted Saunders, CEO of payday lender Community Choice Financial Inc. in Dublin, applauded the ruling. ‘The public messaging around the suit has been very confusing for everyone, there’s nothing illegal or improper about the way we do business in the state of Ohio,’ Saunders told me. ‘This is a big win for my customers, a big win for all the people who rely on our service.’” [Columbus Business First, 6/11/14]

…including Through the Use of Prepaid Debit Cards That Included 400 Percent APR

- Saunders Said He Was “Proud To Provide” Prepaid Debit Cards That Carried Annual Interest Rates Of 400 Percent In Order To Get Around 2008 Law Capping Payday Loans At 28 Percent APR. “CheckSmart has come under attack again from consumer groups for one of its products, just as its parent company prepares to take the Dublin-based payday lender public. The groups, led by the National Consumer Law Center, have complained to federal regulators about CheckSmart’s prepaid debit card, which they say allows the company to get around state law limiting interest rates on payday loans, including Ohio’s 28 percent cap imposed in 2008 by voters. Instead, the company can charge what works out to a 400 percent annual interest rate. ‘Obviously, we have some serious concerns,’ said David Rothstein of Policy Matters Ohio. The CEO of CheckSmart’s parent, Dublin-based Community Choice Financial, said the cards comply with state and federal laws. ‘I find the allegations to be baseless,’ Ted Saunders said. ‘We have the most comprehensive and consumer-friendly set of prepaid cards offered in the marketplace, and we’re proud to provide them.’” [Columbus Dispatch, 5/5/12]

- Saunders Said Criticism Of Pre-Paid Debt Cards Offered By Payday Lenders Were “A New Low.” “Consumer advocates are turning to a federal bank regulator to stop what they say is a payday lender’s use of prepaid debit cards to get around state rules limiting high-cost payday loans. Led by the National Consumer Law Center, 30 advocacy groups have asked the Office of the Comptroller of the Currency to stop Lake Mary, Fla.-based Urban Trust Bank from working with Insight Card Services LLC, owned in part by Dublin-based Community Choice Financial Inc., parent of the CheckSmart chain. The regulator responded by asking the bank to look at the risks and benefits to the prepaid debit card program, but it did not tell Urban Trust to cut ties with Insight. Turning to a third party’s federal regulator could be a stake in the ground for consumer groups frustrated in their efforts to limit payday lenders. After leading a campaign in 2008 to lower the maximum interest rate payday lenders could charge customers in Ohio, advocates have watched those companies turn to lending under different licenses or charging different fees to effectively skirt the limitations. Community Choice CEO Ted Saunders said the prepaid debit cards, which are insured by the Federal Deposit Insurance Corp., serve a growing segment of consumers that is turning away from traditional banks. He thinks consumer groups are playing dirty by going after its third-party partners. ‘I would characterize it as a new low,’ he said.” [Business First of Columbus, 9/28/12]

Said the Legislature Was on a “Witch Hunt” to Close Loopholes

- Saunders Claimed Legislature Was On “Witch Hunt” As It Considered Closing The Loophole. “CheckSmart isn’t using loopholes in the new law to continue offering loans, but rather following statutes that ‘have been on the books for years,’ said Ted Saunders, the company’s chief executive. ‘It seems everyone has a short-term memory,’ Saunders said. ‘The legislature of Ohio encouraged us to make loans under the Small Loan Act, but now they are on a witch hunt.’ He said his customers appreciate the type of loan offered by CheckSmart because ‘it’s the least-expensive option for consumers.’” [Columbus Dispatch, 2/18/09]

- Saunders On Legislative Efforts To Reign in Payday Lenders: “‘They Want To Find A Villain” And His Opponents “Have Done A Good Job Of Painting A Big X On My Back.” “Bills that would have kept the industry alive languished in the House and Senate, and the year’s third and final attempt was pulled Tuesday amid a lack of support. Consumers frustrated with the economy ‘look for a dog to kick’ because they’re angry with the financial institutions they blame for the Great Recession, said Ted Saunders, chief executive of Dublin, Ohio-based Checksmart, a payday lender that operates in 11 states including Arizona. ‘They want to find a villain,’ Saunders said. And opponents ‘have done a good job of painting a big X on my back.’” [AP, 4/8/10]

…and Again Claimed That Regulations Would Cause Layoffs

- Saunders At Hearing On Payday Lending Regulations: “Have You Ever Fired Anybody?” “In a hearing this week, Rep. Stephen Dyer, D-Green, told Saunders that the check-cashing fee ‘just seems wrong to me,’ to which Saunders replied: ‘Have you ever fired anybody?’ Payday operators say they need the fee to stay in business, and customers can choose to cash their checks elsewhere. ‘I don’t want to put any business out of business, but I also don’t want people to get screwed by a cycle of debt, either,’ Dyer said. Critics of payday lending say that because the entire loan, plus fees, is due in just two weeks, many borrowers can’t repay the loan and are forced to take out additional ones. Saunders passed out a book filled with pictures and brief statements from customers praising the company for helping them. ‘They come see us because we are the least-expensive option in the marketplace,’ he said, stressing that the loans are cheaper than bank fees, bounced checks or utility penalties. Lundy told him the book ‘reminded me of a casino when they only put up pictures of the winners, not the losers.’” [Columbus Dispatch, 4/17/10]

Claimed His Customers Were “Appreciative” of Payday Loans and Blamed Them for Misusing the Product When They Went Into Debt

Saunders Blamed Customers for Abusing Payday Loans

- Saunders Blamed Customers For Getting Into Debt With Payday Loans: “There’s A Certain Level Of Responsibility (Needed) When It Comes To Financial Products.” “Ted Saunders, CEO of Dublin-based CheckSmart, a payday and short-term lender, said industry leaders were blindsided by Lundy’s legislation and were not provided an opportunity for input. He said they had been working with lawmakers on the bill pending in the financial institutions committee…Saunders said the percentage of people who get into trouble with payday loans is small compared to those who benefit. ‘There’s a certain level of responsibility (needed) when it comes to financial products,’ he said. ‘Our industry has been branded as somehow tied to the larger financial issues in the country. We didn’t take any TARP money, and we didn’t trade any derivatives. We want to keep doing business in a productive and regulated fashion.’” [Newark Advocate, 5/3/10]

- Claimed That His Customers Were “Appreciative” of Payday Loans and That He “Loved His Costumers” Because He Kept His Payday Lending Stores Open Late and on the Weekends. Saunders Claimed His Customers Were “Appreciative.” “CEO CheckSmart Ted Saunders, though, said there are far less people working in the industry right now and this loophole lingo is going too far when people need small loans. ‘The criticism has been we’re using loopholes to trick the customer into doing something they don’t want to do. You know, I’ve talked to my customers. They’re appreciative of getting loans in this environment,’ Saunders said. Saunders said customers can get their loan check cashed anywhere and the fees are less than what they used to pay. ‘It’s very hard when words like ‘nefarious’ and ‘loan sharks’ spill off the pages of the newspaper. I am following the letter of Ohio law,’ Saunders said.” [WCMH, 2/27/09]

- Saunders Claimed He “Love[d] His Customers” Because They Were Open Late And On The Weekends. “However, Saunders said sometimes it’s more than just fees or bad previous experiences that bring customers to his doors. He said some banks don’t always have a comfortable or very welcoming environment. ‘We love our customers. We’re open early, we’re open late, we’re open on the weekends. We’re happy that our customers have got work. We pursue the customers the way the banking industry would pursue … me. They don’t pursue this demographic as much,’ he said.” [News-Herald, 10/17/10]

Saunders Even Attempted to Offer Financial Advice – Said That Consumers Should Avoid…Debt

- Saunders Released List Of “Money Blunders” That People Should Avoid, Included “Accumulating Too Much Debt” And “Rushing” Into College Debt In The List. “Community Choice Financial, a Columbus, Ohio, financial services retailer that caters to the underbanked demographic, has a list of ‘money blunders 20-somethings should avoid.’ ‘Many 20-somethings are constantly searching for advice to help them achieve long- and short-term financial goals, but it is equally as essential to know what to avoid,’ says Ted Saunders, president and CEO of Community Choice Financial. ‘Be sure to stay away from these common personal finance mistakes.’ Here’s a closer look at what Saunders is talking about:…Accumulating too much debt. Most Americans spent more then they made before the Great Recession, and most have pulled back on spending to get a better grip on their finances. But 20-somethings lack the experience of older consumers and not all got the memo on cutting spending and identifying good and bad debt. ‘Debt such as tuition or owning a home generally has a good return on investment, making them a permissible debt,’ CCF says. ‘Most other types of debt are considered consumer debt, which means you purchased something because you wanted it rather than needed it.’ ‘Rushing’ into more college debt. There’s no rule that says college graduates need to jump right from their undergraduate degrees to a graduate school. In fact, it’s better to wait a few years. CCF advises waiting five full years, and getting some real-world experience (and money in the bank) before going back to school.” [TheStreet.com, 2/27/14]

- Saunders Said His Company Was Participating In Financial Literacy Seminar With The Ohio Black Legislative Caucus Because “His Company Wasn’t Viewed As One That Gave Back To The Community; This Was His Effort To Rectify That.” “Payday lending opponents are in an uproar about a financial-literacy seminar in Cleveland today. The reason? One of the major sponsors is payday lender CheckSmart of Dublin, Ohio. CheckSmart is pairing with the Ohio Black Legislative Caucus and the Congress of Racial Equality to present the free program. ‘I wouldn’t go to CheckSmart for information on improving my credit,’ said Tom Allio, senior director of the Cleveland Diocesan Social Action Office and a leader in last year’s pitched battle to end payday lending in Ohio. ‘One of the sessions is ‘Avoiding Financial Pitfalls,’ ‘ Allio said. ‘I wonder if the participants are going to be advised about the pitfalls of payday lending?’ But CheckSmart Chief Executive Ted Saunders said, ‘These are people who just don’t like us who are attacking something good.’ Saunders said that the seminar covers budgeting basics and that if he ran a bank, no one would question his motives. He said that members of the black legislative caucus advised him during last year’s fight over payday lending that his company wasn’t viewed as one that gave back to the community; this was his effort to rectify that.” [Cleveland Plain Dealer, 10/24/09]

Even Equated Closing Payday Lenders With Closing Hospitals

- “Closing The Payday Lending Industry Because Customers Have Financial Problems Would Be The Equivalent Of Closing A Hospital Because Patients Are Sick.” “But Ted Saunders, CEO of payday lender Community Choice Financial Inc., said his company’s customers defy stereotypes. They’re smart people electing to use a service for a reasonable fee, he said. ”My customers are not un-informed. My customers are not unintelligent. You probably go to church with them,” he said. Closing the payday lending industry because customers have financial problems would be the equivalent of closing a hospital because patients are sick, Saunders said. About 29 million people have outstanding payday loans, and the industry collects about $7 billion a year in fees, consumer advocates and industry officials testified.” [Birmingham News, 1/20/12]

While Saunders Was Complaining About Declining Profits and Layoffs Due to Regulations, He Was Living the High Life – Earning Millions a Year, Lavished With Perks and Mansions

Despite Saunders Claiming That Regulations Would Hurt His Company’s Bottom Line, It Made Millions a Year in Profit

- 2011: Saunders’ Company Earned $17 Million In Profit. “Community Choice turned a $17 million in profit in 2011, but that is a far cry from the $230 million it thought it could bring in when it began its IPO plans in 2011, before lowering expectation to $137 million and then to $107 million prior to terminating its offring.” [Business First of Columbus, 5/18/12]

- 2010: Saunder’s Company Made $31.5 Million In Profit, Announced That It Would Go Public To Retire Debt From Expansion. “The operator of the CheckSmart payday lending store chain is going public to fund its effort to diversify into other consumer financial services. Community Choice Financial Inc. is planning a public stock offering expected to raise $230 million. In an Aug. 23 filing with regulators, the Dublin company said it is an opportune time to offer new financial services as the economy continues to lag and banks impose more fees or cut services in the face of new regulations. ‘We serve the large and growing market of individuals who have limited or no access to traditional sources of consumer credit and financial services,’ the company said in its prospectus. ‘In addition, many banks have reduced or eliminated services that working-class consumers require.’ The IPO awaits regulatory approval, but Community Choice CEO Ted Saunders said he hopes to go to market this year…For Community Choice, that’s where the IPO comes in. ‘The principal reason we’re getting the money is to grow the business or retire debt,’ Saunders said. Debt has grown at Community Choice of late. It did not disclose a purchase price for its California acquisition, but it took on $395 million in debt to pay for the deal and repay other debt, Saunders said. The company made $31.5 million last year on revenue of $224.3 million ‘‘ a profit margin of 14 percent.” [Columbus Business First, 9/2/11]

Since 2011, Saunders Has Personally Made Over $8 Million

2011-2014: Saunders Earned Over $8 Million In Compensation From Community Choice Financial.

[SEC Filings, Community Choice Financial]

- 2014: Saunders Was Awarded A $6,480,047 Retention Bonus Over Three Years. The board of Community Choice Financial in March 2014, Approved Retention Plan awards to Messrs. Saunders, Hanson, and Durbin and Ms. Roman. These awards are subject to a three-year incentive period and provide the following incentive award opportunities: Mr. Saunders, $6,480,047.” [SEC Filings, Community Choice Financial]

- 2014: Saunders Joined Board Of Conn’s Inc., A Home Goods Retailer, And Would Earned $58,333 In Fees And $62,500 In Restricted Stock For His Service. “Conn’s, Inc., a specialty retailer of furniture, mattress, home appliances and consumer electronics, has elected William Saunders, Jr. to its board of directors. Mr Saunders will also become a member of the Audit Committee and the Nominating and Corporate Governance Committee. Mr Saunders has served as CEO of Community Choice Financial since June 2008, after joining the company as its CFO in March 2006. In May 2014, he was appointed as Chairman of the Board.” “Mr. Saunders will also receive $62,500 worth of restricted stock units (“RSUs”) under the Company’s Non-Employee Director Restricted Stock Plan, representing a prorated amount of the annual grant of restricted stock units issued to our non-employee directors. The actual number of RSUs will be based on the closing price of the Company’s common stock on August 1, 2014 and will fully vest on May 27, 2015. In addition, Mr. Saunders will receive $58,333, representing a prorated amount of the annual cash retainer payable in fiscal 2015 to each of our non-employee directors.” [Marketline Newswire, 8/8/14; US Official News, 8/1/14]

…Including Having His Personal Trainer and Car Paid for by the Company

- 2013: Saunders Was Provided With $11,400 Automobile Allowance, Retirement Plan, Personal Use Of Company-Owned Or Lease Aircraft, Personal Trainer Expenses, And Life Insurance. “For 2013, we provided our named executive officers with certain executive perquisites and personal benefits, which we use to attract and retain our executive talent. These perquisites and personal benefits included a $11,400 automobile allowance for Messrs. Saunders, Hanson, Streff and Durbin, employer matching contributions to a 401(k) account and retirement planning for Messrs. Saunders, Hanson, Streff and Durbin and Ms. Roman, rollover of accrued vacation value to a health savings account for Messrs. Saunders, Streff, and Hanson, personal use of company-owned or company-leased aircraft for Messrs. Saunders and Hanson, personal trainer expenses for Messrs. Saunders, Hanson and Streff, company-paid life insurance premiums for the benefit of Mr. Hanson, and employer matching contributions to a health savings account for Messrs. Saunders, Hanson, and Durbin and Ms. Roman. For more information about these perquisites and personal benefits, see the “2013 Summary Compensation Table” and its related footnotes below.” [SEC Filings, Community Choice Financial]

…and Using the Corporate Plane

- 2013: Saunders Billed $34,234 Of Personal Aircraft Usage To The Company. “The amounts reported in this column include: (A) for Mr. Saunders, an automobile allowance, an employer matching contribution to the 401(k) Plan, an employer matching contribution and rollover of accrued vacation value to a health savings account, retirement planning, personal trainer expenses, $34,234 of personal aircraft usage in 2013, and $16,047 for expenses related to his membership in the Young Presidents Organization in 2013.” [SEC Filings, Community Choice Financial]

Saunders Used to Have an Airplane Before He Flew on the Corporate Jet for Free

2002-2003: Saunders Owned A Cessna 172F Airplane:

FAA US Aircraft Registrations

Tail Number: 8666U

Status: Historical

Date First: 3/01/2002

Date Last: 2/01/2003

Last Action Date: 2/27/2002

Certification Date: 2/27/2002

Manufacturer: CESSNA

Model/Series: 172F

Type: Fixed Wing Single Engine

Weight: Up to 12,499

Number of Seats: 4Category: Land

Certification: Not Amateur

Cruising Speed: 105

Number of Engines: 1

Engine Type: Reciprocating

Engine Manufacturer: CONT MOTOR

Engine Model: 0-300 SER

Engine Horsepower: 145

Engine Fuel Consumption: 000000

[LexisNexis, accessed 8/25/14]

Saunders Has Contributed At Least $47,000 to the Campaigns of Politicians and Payday Lending Industry PACs Over the Years [Center for Responsive Politics, 5/23/16]

- 06/27/2006 – 2,000 – Tiberi, Patrick

- 06/28/2006 – 2,000 – Ney, Bob

- 06/30/2006 – 1,000 – Gillmor, Paul

- 06/30/2006 – 2,000 – Pryce, Deborah

- 09/07/2006 – 1,000 – Hobson, Dave

- 09/12/2006 – 1,000 – LaTourette, Steve

- 06/30/2007 – 2,000 – Gillmor, Paul

- 08/13/2007 – 1,000 – Shelby, Richard

- 09/18/2007 – 1,000 – Jones, Stephanie Tubbs

- 11/28/2007 – 5,000 – CheckSmart Financial LLC PAC

- 12/02/2007 – 2,000 – Tiberi, Patrick

- 10/27/2008 – 1,000 – Maloney, Carolyn

- 07/27/2009 – 1,000 – Isakson, Johnny

- 10/25/2010 – 5,000 – CheckSmart Financial LLC PAC

- 12/27/2011 – 5,000 – CheckSmart Financial LLC PAC

- 12/31/2012 – 5,000 – CheckSmart Financial LLC PAC

- 12/31/2014 – 5,000 – CheckSmart Financial LLC PAC

- 12/31/2015 – 5,000 – CheckSmart Financial LLC PAC

- Total – $47,000

Special thanks to National People’s Action for allowing Allied Progress to use its extensive research on payday lending industry executives.