Floridians for Financial Choice: Tying Itself in Knots Defending Disastrous “Florida Model”

[Floridians for Financial Choice, Website Accessed 5/13/16]

RHETORIC: Floridians for Financial Choice Claims Florida “Found a Proven Solution to Protect Consumers” and Should be a “Model for the Nation”

REALITY: Experts, Civil Rights Groups, And Consumer Groups Agree: Florida’s Payday Lending Law Does Not Offer Strong Consumer Protections

Politifact: “No Expert We Interviewed Consider Florida’s Law to Be ‘Stronger Than Almost Any Other State.’” “We will fact-check Murphy’s claim that Florida’s payday lending law is “stronger than almost any other state.” We found that consumer groups, independent researchers at Pew Charitable Trusts and the federal Consumer Financial Protection Bureau have raised multiple criticisms of Florida’s law. No expert we interviewed consider Florida’s law to be ‘stronger than almost any other state.’” [Politifact, 4/12/16]

Politifact: “No Academic or Consumer Expert We Interviewed Argued That Florida’s Law Should Be Considered Any Sort of National Model.” “However, no academic or consumer expert we interviewed argued that Florida’s law should be considered any sort of national model. “One can’t say across the board Florida is a state that has somehow reined in payday lenders in comparison with other states,” said Auburn University professor James Barth who wrote a paper on payday lending.” [Politifact, 4/12/16]

More Than 200 Consumer or Civil Rights Groups Wrote a Letter to Congress Arguing That The “Industry-Backed Florida Law” Hurts Consumers. “Consumer advocates say that Florida’s payday law is no model. More than 200 consumer or civil rights groups — including the NAACP, National Council of La Raza, Southern Poverty Law Center, and the Consumer Federation of America — wrote a letter to Congress arguing that the “industry-backed Florida law” would hurt consumers. Among nine groups from Florida fighting the law is the Florida Alliance for Consumer Protection.” [Politifact, 4/12/16]

RHETORIC: Floridians for Financial Choice Called It A “Myth” That “Payday Lenders Impose Excessive Fees On Loans” And A Myth That “Payday Loans Have Outrageously High ‘APR’s’”

REALITY: Typical Florida Payday Loan APR is 304%

A Typical Payday Loan in Florida Charges 304% APR, And Most Florida Payday Loan Customers Take Out Nine Payday Loans a Year. “Data compiled by the nonpartisan Pew Charitable Trusts is similarly dismal. A typical Florida payday loan customer ends up taking out nine payday loans a year and is stuck in debt for nearly half of that year, according to Pew. The average interest rate on Florida’s payday loans is 304 percent — only slightly better than the 390 percent annual average. Critically, the average payday loan amount of $389 is equal to 35 percent of average paychecks in the state — in line with national figures.” [Huffington Post: “DNC Chair Joins GOP Attack On Elizabeth Warren’s Agency”, 3/1/16]

- The National Council of La Raza and The Center for Responsible Lending Released a Report Showing That Florida Payday Lenders Collected $2.5 Billion in Fees Since 2005. “While some analysts argue that the federal government’s proposal to regulate payday loans is detrimental to consumers, policy change may be necessary to keep communities of color from falling into cycles of debt, according to a report released Thursday by the National Council of LaRaza. The Center for Responsible Lending, in partnership with the council, analyzed a decade of data related to Florida’s payday lending practices. These businesses have collected $2.5 billion in fees since 2005, according to the report.” [Marketplace: “Are Payday Loans Hurting Minorities?”, 3/24/16]

Check into Cash Advertises a Payday Loan with an APR of 391.07% In Florida. [https://checkintocash.com/florida/]

Amscot Financial Advertises Payday Loan Rates as High as 312.86%. [Amscot.com]

RHETORIC: Floridians for Financial Choice Claimed “Assuming a 365-Day Loan Period, the APR is Actually a Flat 10%.”

REALITY: This Hypothetical Loan Can’t Exist, Because Florida Law States That Payday Loan Terms Can’t Be Longer Than 31 Days

Florida Law: The Loan Term Cannot Be Longer Than 31 Days. “The loan term cannot exceed 31 days or be less than 7 days.” [Florida Office Of Financial Regulation]

RHETORIC: Floridians for Financial Choice Called It A “Myth” That “Borrowers Get ‘Trapped’ Or ‘Stuck’ In Cycles of Borrowing” And A Myth That “Most Borrowers Take Out More Than 8 Loans A Year”

REALITY: Florida Payday Loan Consumers Still Trapped in A Cycle of Debt Averaging Almost 9 Loans Per Year and One Third Taking Out 12 Or More Per Year

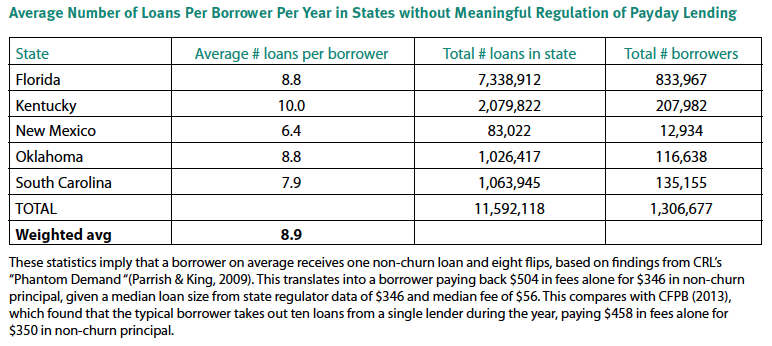

[Center For Responsible Lending, September 2013]

32.7% Of Florida Payday Loan Customers Took Out 12 Loans or More Per Year. [Veritec Solutions Report For The Florida Office Of Financial Regulation, May 2012]